Knowledge of interest rates is vital when managing finances, investments, and borrowing money. Two terms commonly mentioned when discussing interest rates include nominal and real interest rates – in this article, we’ll highlight their main distinctions, along with how they influence financial decision-making processes.

What are Nominal Interest Rates?

Advertised or stated interest rates, also referred to as advertised or stated rates, are those explicitly advertised by lenders or financial institutions and represent the actual percentage earned on loan investments without factoring inflationary changes into account.

Nominal interest rates are expressed as annual percentage rates and are often included as an element in loans, savings accounts, and other financial agreements. When banks announce annualized interest rates of 5% annually on savings accounts this indicates the savings account will earn interest at this annualized rate of 5.

Nominal interest rates don’t take inflation into account which increases costs over time and reduces money’s purchasing power over time. Thus while nominal rates give an accurate indication of interest paid or earned per period but don’t provide a realistic picture of what actual investments worth in terms of buying power are worth.

To account for inflation and obtain an accurate measurement of real return on borrowing or investment costs, it is vitally important to use true interest rates. Real interest rates account for inflation while giving a more complete picture of profits or losses relative to purchasing power.

Calculation of Nominal Interest Rates

Calculating nominal interest rates depends upon a variety of circumstances and financial instruments being employed, as each has different methods for doing so.

Here are a few common approaches for estimating nominal rates:

Simple Interest Calculation: In simple interest computation, the interest rate is expressed as an annual percentage rate, and using this formula can help calculate it.

Simple interest equals the principal amount multiplied by the nominal Rate period.

- Example 1: Assuming you borrowed $1,000 at an interest rate of 5% annually over two years, then the basic interest rate would be:

- Simple Interest Calculation = $1,000 multiplied by 0.05 + 2.

- Total due would include both principal ($1,000) and the interest rate for simple ($100), totaling to an amount owing of $1,100.

- Compound Interest: “Compound interest” refers to any rate calculated using compound interest’s effect of compounding; when interest accrues on both principal and any accrued accrued interest at once.

Here is how the compound interest formula works:- Compounded Interest = Principal (1 + Nominal Rate)Number of Periods >Primary Amount.

- Example of compound interest calculation. Say you invest $5,000 at an interest rate of 8% annually compounded over 3 years; its compound interest would total $6324.

- Compound Interest equals $5,500 * (1 + 0.083)3 + $5,000 = $1,255.20.

- Three-year investment returns would consist of a principal ($5,000) plus interest compounded ($1,255.20), totaling $6,255.20.

- Annual Percentage Rate (APR): APR is the term most often used to denote nominal interest rates associated with financial products like mortgages, loans, and credit cards. APR also accounts for any additional costs or fees associated with loans or credit and includes them alongside the nominal interest rates. Calculating APR requires taking several factors such as compounding periods as well as fees and repayment plans into consideration in its calculations; financial institutions usually publish this figure publicly to assess costs when offering loan products and options.

Various financial instruments and situations may use various methodologies for computing the nominal rate. It would be prudent to consult specific terms and conditions or consult financial specialists for exact calculations in particular scenarios.

What are Real Interest Rates?

Real interest rates are the interest rates that are adjusted to account to reflect inflation, allowing an accurate measurement of the real return on borrowing or investment costs by calculating purchasing power. In contrast to nominal interest rates that do not take into account inflation, real interest rates take into account the effect of inflation on the worth of money in time.

To determine the real interest rate the rate of inflation will be subtracted by the nominal rate.

The formula to calculate the real rate of interest is as the following:

Real Interest Rate – Nominal Rate Inflation Rate

For instance, if the nominal interest rate for an unsecured credit is 7 percent annually with an inflation of 3% then the actual cost of borrowing would equal 4% annually.

The real interest rate is crucial as they allow for an accurate estimation of the real return on investment or expense of borrowing. When you take into account inflation real interest rates show the changes of purchasing power as time passes. A positive positive real interest rate signifies that the loan or investment generates a return that surpasses inflation, which increases the power of purchase. An interest rate that is negative signifies that the return on investment or cost of borrowing is less than inflation which results in a decline in purchasing power.

The analysis of real interest rates allows people, companies, and policymakers to make better financial decision-making. It aids in assessing the real value of investments, comparing various choices in investment, assessing the cost of borrowing accurately, and assessing the effect of inflation on investments and savings.

Calculation of Real Interest Rates

To determine the actual interest rate, subtract inflationary trends from nominal rates to calculate real interest.

Here is how:

Real Interest Rate = Nominal Inflation Rate

Below is a step-by-step method of finding out your true interest rate:

- Determine the Nominal Interest Rate: Before setting out to determine the nominal interest rate for any loan or financial instrument, first determine its nominal rate of interest. Let’s use an example whereby this could be 6% per annum as an example of what that might look Like.

- Find an Inflation Rate: To establish inflation for any period that corresponds with it, the inflation rate can be obtained through reliable sources like economic indicators or government reports. Assume for now that inflation stands at 2% annually.

- Subtract Inflation Rate from Nominal Interest Rate Step One To determine this calculation: Real interest rate = 6.6% plus 2 = 44 percent. Thus, the true annualized interest rate stands at 4% per annum.

Real interest rate refers to an adjusted rate of interest that accounts for inflationary effects and measures the rise or fall in purchasing power and real return on investments over time, adjusted by changes in currency value.

Calculating the true interest rate can assist both individuals and companies in making informed financial decisions by providing an evaluation of real investment value, comparing various investment alternatives, and considering inflation’s effect both for borrowing costs as well as return on investments.

Factors Affecting Nominal and Real Interest Rates

A variety of factors can impact both real and nominal rates of interest.

Here are a few key elements that influence the rates:

- Inflation Expectations: Inflation expectations are a key factor in determining real and nominal interest rates. If investors and individuals anticipate rising inflation in the coming years, banks will require more interest rates at nominal levels to cover the declining price of currency. Therefore, real rates are also affected because inflation expectations affect the gap between real and nominal rates.

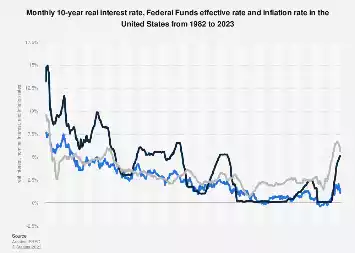

- Central Bank Policies: Central banks, including that of the Federal Reserve in the United States, can determine the monetary policy that affects the rate of interest. Using changing to the interest rates that are benchmarked or the implementation of quantitative ease, central banks seek to boost or limit economic activity. The changes in the central bank’s policies could affect real and nominal interest rates in that they affect the cost of borrowing as well as investment returns and inflation expectations.

- Economic Growth and Inflationary Pressures: The economic state and inflationary pressures have a significant impact on interest rates. Economic expansion often drives demand for credit to rise rapidly, which drives up borrowing costs as well as rates of interest. Inflationary pressures, caused by factors such as a rise in consumer spending or disruptions in supply chain processes could also increase real and nominal interest rates.

- Fiscal Policy and Government Debt: The levels of government debt, as well as fiscal policies, can affect the rate of interest. If a country accumulates a lot of debt, investors could require higher nominal rates to offset some of the risks. Furthermore, fiscal policies that are expansive like more budgets for government or tax cuts, could create pressure for interest rates, by boosting economic activity and possibly increasing inflation expectations.

- Global Economic Situation: Economic factors worldwide such as foreign trade and exchange rate and geopolitical developments, may influence the interest rate. Changes in the global economy could impact the sentiment of investors, inflation, as well as borrowing expenses, which can lead to a change in real and nominal interest rates.

- Risk and creditworthiness: Risk and Creditworthiness investing or lending can also impact interest rates. The lender may offer more nominal interest rates to borrowers with less creditworthiness or to cover the perceived risk. In the same way, investors could require higher investment returns to offset more risk. Risk-related factors impact both real and nominal interest rates.

It is important to remember that the importance and the impact of these variables can differ throughout time and between different states or even regions. The fiscal and financial policy choices financial indicators, market sentiment, and a variety of other variables can affect the rate of interest in various ways.

Importance of Nominal and Real Interest Rates in Investments

Real and nominal interest rates play an essential role in making decisions about investing, providing information regarding returns potential as well as inflation effects.

Here are some reasons for their relevance when making investment choices:

- Assessing Returns on Investments: Nominal interest rates enable investors to assess the returns offered by various investment choices. A higher nominal interest rate often indicates greater potential returns, making certain investments more appealing. By comparing nominal interest rates across several investment options, investors can make informed decisions regarding which ones they wish to undertake.

- Accounting for Inflation: The real interest rate plays a pivotal role in accounting for inflation’s effects on investment returns. Over time, inflation reduces the purchasing power of money which reduces gains from investments; real interest rates adjust for this impact to provide investors with an accurate measure of real returns on investments; using them, investors can assess whether their yield exceeds inflation by using this precise measurement as they attempt to preserve or increase purchasing power through investments.

- Examining Risk: Adjusted Returns of Investments Both nominal and actual interest rates provide investors with insight into potential risks and rewards from an investment, with higher nominal rates indicative of greater risks, such as lending money to those with less creditworthiness. By comparing nominal with real amounts invested, investors can determine whether risk-adjusted return compensates them adequately and assess if their risks have been balanced out by rewards in some way.

- Time and Interest Rate Sensitivity: The nominal interest rate plays an essential role in assessing how sensitive specific investment portfolios are to fluctuations in interest rates, particularly bonds or fixed-income securities which tend to be very sensitive when interest rate changes occur. A shift could influence yield or value changes on these securities and therefore potentially alter returns they can earn in addition to overall portfolio performance.

- Finance and Retirement Income: Understanding the real and nominal interest rates is vital when planning for retirement income, especially using investments or savings accounts as sources. Nominal rates of interest allow individuals to calculate earnings they make from these sources while real rates account for inflation’s effect on buying power of earnings during retirement years. By considering both real and nominal rates together, people are better able to meet their financial requirements while creating sustainable sources of retirement income.

- Economic Market Sentiment and Indicators: Real and nominal interest rates are key economic indicators, providing insight into both inflation pressures as well as market sentiment. Analysts and investors closely watch interest rate trends to gain a comprehensive picture of economic conditions while making informed investment decisions about bonds, stocks, and real estate assets. Changes could alter market behavior which ultimately impacts asset classes such as bonds, stocks, and real estate assets.

Monitoring real and nominal interest rates enables investors to make educated decisions, evaluate risk-return tradeoffs, and adapt their investment strategies in response to changing economic environments. By considering both types of rates as indicators for interest they are better equipped to assess investment opportunities, safeguard purchasing power, and strive for optimal returns from their investments.

Impact of Inflation on Nominal and Real Interest Rates

Inflation can have a dramatic impact on nominal and real interest rates, altering borrowing costs and investment returns – not to mention general economic conditions – all at once.

Here is how inflation alters nominal and real rates of interest:

- Indicative Interest Rates: The rate of inflation tends to have an indirect positive relationship with interest rate nominal. When inflation expectations increase and lenders demand higher nominal interest rates to offset cash’s decreasing purchasing power over time; they must account for this when repaying. A higher nominal interest rate helps preserve true worth while at the same time providing them with returns that mirror inflation’s expected pace of increase.

- Real Interest Rates(Real): Real interest rates are determined by subtracting inflation rates from nominal rates of interest since inflation represents changes to our purchasing ability over time. When nominal interest rates exceed inflation rates, their real rate can become positive (meaning that loan or investment returns exceed inflation); conversely, when nominal interest rates fall short, real rates become negative due to investments or loans with returns that exceed inflation or borrowing costs that surpass it resulting in positive real rates, with positive real rates representing investments or costs exceeding inflation rather than vice versa.

- Price Power: Inflation slowly reduces your purchasing power over time due to rising costs. Unfortunately, nominal interest rates do not accurately represent how this impacts real amounts of cash; real interest rates instead provide more accurate measures of actual returns or costs associated with borrowing as a percentage of purchasing power; these reflect any increases or decreases caused by loans and investments respectively.

- Investment Choices: Inflation plays an essential part in investment decision-making. As inflation raises costs associated with returns on investments and lessens their appeal to investors, those hoping to maintain or increase purchasing power generally look for investments offering gains higher than inflation rates; increased inflation expectations could cause nominal interest rates to increase which in turn impact risk-reward calculations and impact decisions accordingly.

- Economic Recession: Banks often alter nominal interest rates to combat inflation. If it reaches high levels, banks could raise nominal rates to restrict spending and ease pressure off inflationary pressures; conversely, when inflation levels decrease significantly banks might decrease nominal interest rates to promote economic activity and stimulate borrowing and investing decisions – an alteration that aims at controlling both inflation and growth by impacting the cost of borrowing or investments decisions.

Understanding the relationship between inflation, nominal interest rates and real rates of interest is of vital importance for borrowers, investors, and policymakers alike. Understanding these aspects allows individuals to make educated financial decisions; evaluate options for investments; examine costs associated with borrowing directly and measure its effect on personal financial health – this allows individuals to make well-informed financial decisions and calculate its effect.

Comparing Nominal and Real Interest Rates: An Example

Let’s look at an example to evaluate real and nominal rates of interest:

If you’ve got the following details:

Nominal Interest Rate: 8% per annum Inflation Rate: 3 % per year

- Calculation of the Nominal Interest Rate: It is simple because it is clearly stated. In this scenario, the nominal interest amount is 8 percent annually.

- Real Interest Rate Calculation: To determine real rates of interest subtract the rate of inflation from the nominal interest rate

The real Interest Rate is the same as the Nominal Ratio minus Inflation Inflation Rate: 8% + 3 Real Interest Rate is 5% per year

In this instance, the true annual interest is 5 percent annually. That means that, after taking into account inflation the loan or investment will likely yield a return of five percent per year when it comes to purchasing power. The real rate of interest of 5% means that the return on investment or cost of borrowing is greater than what inflation rates are, which allows for a rise in purchasing power over time.

Comparing real and nominal rates of interest helps both borrowers and investors understand the effects that inflation has on investments or loans. Real interest rates provide an accurate measurement of the actual gains and losses in the form of buying power, which allows better financial decision-making.

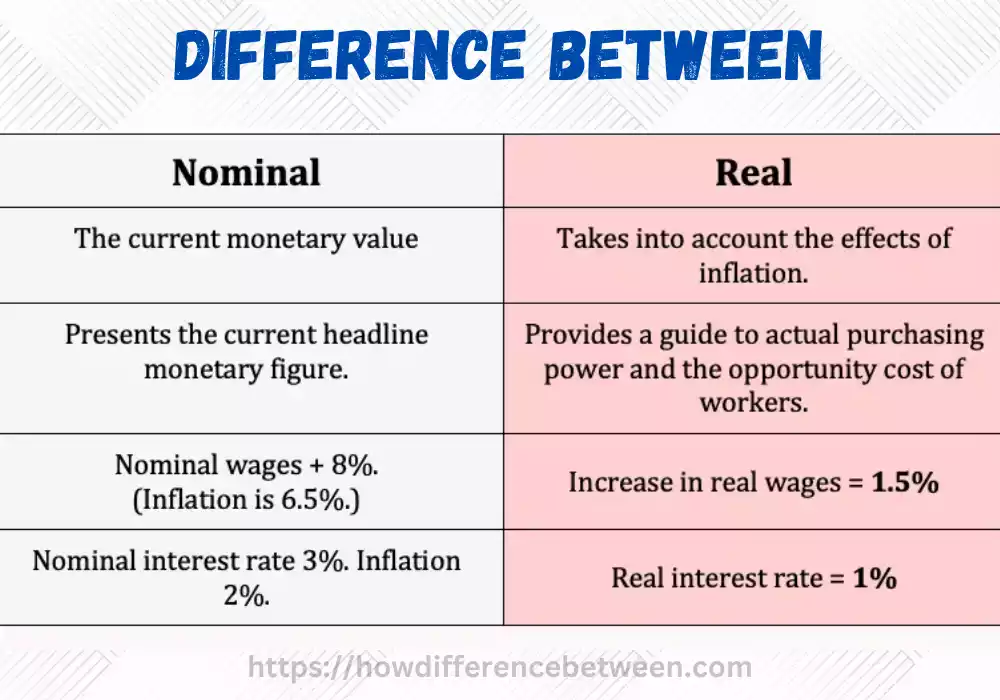

Comparison Chart

Here’s a comparison chart highlighting the key differences between nominal and real interest rates:

| Aspect | Nominal Interest Rates | Real Interest Rates |

|---|---|---|

| Definition | The stated rate of return or cost of borrowing | Adjusted for inflation, reflects purchasing power |

| Inflation Adjustment | Does not account for inflation | Accounts for inflation |

| Calculation | Actual interest rate as stated by the lender | Nominal interest rate minus the inflation rate |

| Purpose | Immediate comparisons, market trends | Assessing purchasing power, long-term planning |

| Impact of Inflation | Ignores inflation | Reflects inflation’s effect on returns |

| Affordability of Debt | Determines the cost of borrowing | Considers the real cost of debt service |

| Investment Comparison | Useful for comparing similar nominal returns | Evaluates returns in terms of real purchasing power |

| Risk-Adjusted Returns | Does not explicitly consider risk adjustments | Considers returns adjusted for inflation and risk |

| Relationship to Inflation | Varies with inflation levels and expectations | Reflects the impact of inflation on returns |

| Influence of Central Banks | Affected by central bank policies and decisions | Can be influenced by central bank actions |

The Role of Central Banks in Determining Nominal Interest Rates

Central banks play a crucial role in determining nominal rates by implementing policies monetary. Monetary policy refers to decisions that central banks take to manage the quantity of money and credit availability as well as interest rates to reach macroeconomic goals.

Here’s how central banks affect the nominal rate of interest:

- The setting of a Benchmark interest rate: Banks in Central America usually determine a benchmark rate of interest which is sometimes referred to by the term “the policy rate” or central interest rate. The benchmark rate is a benchmark for other interest rates throughout the economy. Central banks rely on the benchmark rate to communicate their monetary policy and affect the cost of borrowing. By adjusting the benchmark rate of interest, central banks directly affect the nominal rates of interest imposed by commercial banks. These will in turn affect the rate of lending to people and businesses.

- Open Market Operation: Central banks participate in open market operations which involve buying or selling government bonds and other securities on the market. If central banks wish to reduce the nominal rate of interest, they purchase government bonds and inject funds into the bank system. The increase in money supply reduces short-term interest rates, which encourages spending and economic activity. In contrast when central banks are looking to raise interest rates on nominal accounts by selling bonds issued by the government and reducing the amount of money available and increasing the short-term rate of interest.

- Reserve Requirements: Central bankers can establish the requirements of the reserve for commercial banks. Reserve requirements define the amount of funds commercial banks are required to keep as reserves against deposits from customers. By altering reserve requirements, central banks may influence the lending capacity and liquidity of commercial banks. Higher reserve requirements could reduce the amount of money that is available for lending, which can lead to higher interest rates for nominal loans.

- Forward guidance: The central banks give forward guidance regarding their plans for monetary policy. Through speeches, statements, or official announcements, the central banks give information about the rate of interest based on their evaluation of the economic situation. Forward guidance can affect market expectations and can affect the long-term interest rate, which includes corporate bond and mortgage yields.

- Quantitative Easing (QE): (QE) A time of economic crisis or recession central banks can utilize unconventional monetary policy tools such as quantitative ease. QE is the process of buying long-term bonds issued by the government or other assets owned by central banks. This increases the quantity of money and reduces the long-term rates of interest. In reducing the costs of borrowing in the long term central banks seek to increase the economy and encourage investing and lending.

Central banks’ decisions on the nominal rate of interest are governed by their mandate to keep the stability of prices, encourage full employment, and encourage the sustainable growth of our economy. They constantly examine economic indicators, including the rate of inflation, employment statistics GDP growth, inflation, and the state of the financial markets to determine the proper rate of interest. By influencing the nominal rate, the central banks try to direct the economy towards their objectives in the policy area and to maintain the stability of the system of finance.

Significance of Real Interest Rates in Assessing Investments

Interest rates that are real play an important part in evaluating the value of investments and forming informed financial decisions.

Here are a few reasons why interest rates are crucial when evaluating investment opportunities:

- Accounting for inflation: Real interest rates are based on the effect of inflation on the return on investment. Inflation decreases the purchasing capacity that money has over time decreasing the value of gains from investments. When considering the actual interest rate that investors can determine whether an investment will yield returns that exceed inflation and improve their purchasing ability. Real interest rates offer an accurate measurement of the actual return from an investment by assessing its capacity to keep up with or even beat inflation.

- Assessing investment performance: Real interest rates allow investors to gauge the performance of their investments in a meaningful manner. Just looking at nominal returns could be misleading, especially if they do not reflect changes in living costs. Comparing the actual rates of various investments allows one to make a fair assessment of their potential to produce returns that outpace inflation. Investors should focus on investments that have high accurate rates of interest, which indicates that they have outpaced inflation and offer the possibility of an accumulation of wealth.

- Risk-adjusted return: Real interest rates assist investors evaluate the risk-adjusted return of their investments. The investments with higher nominal rates can appear appealing however when inflation is equal or even higher, the actual returns could be very low and even negligible. When considering the real rate of interest investors can gauge the returns about the risk in the investment. It gives a clearer understanding of the capacity of the investment to offset inflation and any other risks that are involved.

- The Financial Plan and the Retirement: Fund Interest rates are really vital in planning financials, particularly for long-term goals, such as retirement. If you are planning to retire it is vital to determine the amount of money that is earned from investments and savings. When you factor in the real interest rate, investors can estimate the growth rate of their savings in terms of real dollars, and ensure that the retirement income they earn maintains or improves their purchasing power as time passes.

- Making informed investment decisions: Real interest rates can help investors make better-informed decision-making about investments. When considering the actual returns of various investment options, investors can evaluate the merits of different investment opportunities. Investments that pay higher real interest rates have the chance of significant accumulation of wealth and the preservation of buying power. Real interest rates are a good way to aid investors in choosing investment options that are in line with their objectives in terms of financial goals, risk tolerance, and long-term preservation of wealth goals.

- Economic Indicator: Real Interest rates are an economic indicator that shows the overall condition of the economic system. Real interest rates fluctuate and could indicate changes in the cost of borrowing or investment affluence, as well as economic conditions. Analysts and investors closely watch real interest rates to get insights into inflation expectations, the effectiveness of monetary policy, and possible impacts on a variety of segments of the economy.

When you consider the effect of inflation real interest rates can provide an improved understanding of investment performance, risk-adjusted yields as well as the capacity of investments to protect or increase the purchasing power of consumers. They allow investors to make informed choices, determine the worth of investments, and ensure that their investment strategies are aligned with their financial objectives.

How Nominal and Real Interest Rates Affect Borrowing Decisions

Real and nominal interest rates play an influential role in borrowing decisions, from the cost of borrowing, affordability of loans, and the overall viability of borrowing decisions.

Here is how nominal and actual rates of interest impact borrowing choices:

While these actions might help some, for others they present obstacles that need to be surmounted for life itself to progress forwards in an upward spiral of success.

- Cost of Borrowing: Nominal interest rates have an enormous effect on how much borrowing costs. When interest rates for nominal are high, lenders incur greater borrowing expenses as they must pay higher amounts in terms of both nominal interest rate payments and total costs over their loan duration; in comparison with lower nominal rates which result in decreased costs associated with loans as a whole and resultantly, reduced total interest charges overall.

- Loan Repayments and Affordability: The nominal interest rates that determine borrowing costs have an enormous effect. High nominal interest rates can cause monthly loan payments to skyrocket, straining budgets while becoming insurmountable financial obligations for some borrowers. On the contrary, lower nominal rates make loans more manageable and affordable – one-factor consumers consider before borrowing money is its cost.

- Real Cost of Borrowing: Real Interest Rates as Indicators of Inflation Real interest rates provide an indirect measure of inflation that allows lenders to assess the true price of borrowing relative to purchasing power. When inflation peaks, nominal rates may also become excessive as lenders try to counteract any decline of purchasing power over time; but when considering inflation’s effect as well, real rates offer a more accurate representation.

- Economic Activity and Investment: Borrowing decisions are intricately tied to economic and investment activity. Low-interest rates encourage borrowing funds for investment as capital costs decrease; companies may take out more loans when borrowing costs decrease than when interest rates remain more expensive, while individuals might borrow to fund home purchases or education when rates of interest become attractive – providing credit affordability affects decision-making processes and the growth of economies overall.

- Credit Demand and Supply: Demand and Supply for Credit nominal interest rates affect both demand and supply for credit; when nominal rates are too high, lenders may hesitate to take on loans due to the high costs of borrowing resulting in decreased demand which in turn reduces lending by financial institutions. Conversely, lower interest rates could boost credit demand because borrowers find borrowing with reduced costs attractive; financial institutions could then respond by expanding lending capacities accordingly in response to rising demands for lending credit.

- Financial Policy: Central banks use nominal interest rates as part of their monetary policy to implement an economic stance and control inflation rates, among other variables. By raising or lowering nominal rates based on assessments of growth in inflation rates across economies as well as any changes made by central banks to their policies affecting the affordability of borrowing across an economy – creditors closely watch any decision by central banks since such decisions directly affect access and affordability for credit.

Attaining financial health requires taking an analytical approach when borrowing. Real and nominal interest rates play a part in this decision because they affect borrowing costs, loan affordability, and overall economic activity – thus having an effectful influence on borrowing decisions made by consumers. When making these decisions they also consider inflation expectations when making borrowing decisions.

Nominal vs. Real Interest Rates: Which One to Consider?

If you are considering nominal and. actual interest rates Both have importance based on the particular situation and the purpose of the investigation.

Here’s a list of the best times to take into consideration each type of rate:

Be aware of Nominal Interest Rates if:

- Comparison of Investment Option: The nominal rates of interest are helpful when comparing investment options that provide comparable nominal yields. It permits a straight comparison of the returns stated without weighing the effect of inflation.

- Monitoring market trends: Nominal interest rates offer insight into the current interest rates and changes. The monitoring of fluctuations in interest rates may aid in understanding the conditions of markets, expectations along with the direction and scope of the monetary policy.

- Evaluating Debt Service: To determine the cost-effectiveness of debt services, the nominal rates of interest are important. The borrower must consider the amount of interest they’ll have to make, ignoring the need to account for inflation.

Be aware of Real Interest Rates at the time:

- Examining the Purchasing Power: Real rates of interest are vital when evaluating investments or loans about their effect on purchasing power. It reflects the impact of inflation and gives more precise information about the actual gains and losses that are based on actual wealth accumulation.

- Long-Term Planning: Actual Interest rates are crucial when planning long-term financial plans like the retirement fund or other major investments. With the help of real returns, people can determine if the investments they make will be able to outperform inflation and increase or maintain their purchasing power over time.

- Risk-adjusted return: Real interest rates can help determine the risk-adjusted returns for investment. They account for inflation and reflect the return proportional to the risk. Real interest rates permit a more precise assessment of the viability and value of investments.

In short, both nominal and actual interest rates play a role in various contexts. Nominal rates can be beneficial for quick comparisons and analyzing market trends and trends, while real rates offer a more precise analysis of buying power, long-term planning, and risk-adjusted return. Examining both kinds of interest rates could help you understand the financial implications and assist you to make educated decision-making.

Limitations of Nominal and Real Interest Rates

While both nominal and real rates of interest are excellent instruments to evaluate the financial impact of investments and making financial decisions It is important to know their limitations.

Here are a few limitations for both nominal and real interest rates:

Limitations on Nominal Interest Rates

- Not paying attention to inflation: Nominal interest rates don’t reflect inflation, which may dramatically affect the buying power of investment returns. If you focus solely on nominal rates, it could lead to an incorrect evaluation of the true worth and the profitability that an investment will bring.

- Different rates of inflation: different investment types could be affected by various rates of inflation. The use of only a nominal interest rate that applies to all investments does not take into account the various inflation rates across asset classes or sectors and asset classes, which leads to an insufficient analysis.

- Changes in Inflation Expectations: Nominal interest rates do not reflect the change in inflation expectations in the course of the course. Expectations about inflation can affect the market as well as investment choices, which makes it essential to include these expectations in a comprehensive analysis.

Limitations on Real Interest Rates

- Uncertain Measurement of Inflation: Calculating the real interest rate requires a precise measurement of inflation. But measuring inflation accurately is not easy, and various methods may yield slight differences in outcomes. This uncertainty could lead to some degree of error in the calculation of the real interest rate.

- Individual Inflation Experience: Real-time interest rates are calculated based on average inflation rates. These could not be a reflection of the individual’s personal experience with inflation. People may experience more or less inflation according to their habits of consumption geographical location, consumption patterns, and a variety of other factors.

- Effect of Other Factors Impact of Other Factors: Real interest rates don’t reflect other factors that could affect the performance of investments, including taxes, transaction costs as well as market volatility. These variables can impact the returns that are earned by borrowers and investors and borrowers, in addition to the adjustments that are made to account to account for inflation.

- Time Horizon Considerations: Real rates of interest can vary based on the time frame for the investments. Inflation rates may fluctuate in time, resulting in different calculations of real interest rates for investments that are short-term as opposed to long-term. Not taking into account the proper time frame can lead to an inaccurate assessment of the investment’s real value.

- Limitations and assumptions of Models: Calculation for real rates is based on the economic model and assumption. The models could have limitations or simplifications that can affect the accuracy of calculations for real rates of interest. You must be aware of assumptions that are made and the possible limitations of the models utilized.

It is essential to be aware of the limitations of real and nominal interest rates to aid in the analysis of various other indicators of financial performance, analysis, and personal circumstances. A comprehensive analysis that includes a greater number of factors will provide an accurate evaluation of investment options and financial decision-making.

The Relationship between Nominal and Real Interest Rates

Inflation plays an increasingly influential role in shaping real and nominal interest rate relationships.

Here are the primary influences:

- Adjustment for Inflation: One major distinction between nominal and actual rates of interest lies in their different approaches to inflation: nominal rates do not account for it while real interest rates adjust for it, reflecting real purchasing power when making returns; real rates also take into account fluctuations in cost-of-living fluctuations that might decrease or increase purchasing power over time.

- Inflation’s Effect: Inflation has an immediate and direct influence on real and nominal interest rates. When inflation is moderate or below, nominal rates usually outpace real interest rates resulting in reduced purchasing power loss while investors or borrowers keep or increase wealth over time. Conversely, when inflation exceeds high thresholds nominal rates must rise more to offset declining purchasing power and achieve zero real interest rates in response.

- Expectations and Risk Premiums: The relationship between real and nominal interest rates can also be affected by inflation expectations and risk premiums, particularly as investors anticipate an upsurge in inflation that threatens earnings. Furthermore, lenders who perceive that certain borrowers present greater default or other uncertainties might need to charge them higher nominal rates to offset any perceived risks; this could alter how real and nominal rates interact.

- Central Bank Policy: Central banks play an essential role in shaping the relationship between nominal and real interest rates, through their monetary policy choices, which directly influence nominal interest rates that could eventually affect real ones – for instance, if they raise base interest rates to counter inflationary pressures this could increase nominal rates which, subsequently, result in more real rates as inflationary pressures mount up resulting in greater nominal ones as a consequence of additional nominal rates being added on top.

- Economy: Real and nominal rates of interest may depend upon both the general economic environment as well as where we are in our economic cycle.

Understanding their relation helps evaluate the effects of inflation on returns to investments as well as assess whether borrowing costs remain affordable – crucial steps toward devising sound economic policies that control economic conditions effectively. By considering both real and nominal rates simultaneously individuals and policymakers can make informed financial and policy decisions that reflect their objectives and goals more accurately.

Conclusion

Real and nominal interest rates are important concepts in finance with distinct functions and considerations. Nominal interest rates are the declared rate of return for an investment, or borrowing, but do not account for inflation. Actual interest rates on the contrary, are adjusted to reflect inflation and offer a measure of the real buying power of returns, or the actual costs of borrowing.

Real and nominal rates of interest have significance dependent on the context and goals of the study. Nominal rates can be helpful for quick comparisons, monitoring trends in the market, and evaluating the ability to pay for debt. Real interest rates are, are vital for evaluating the purchasing power of a consumer, planning for the future in risk-adjusted return, as well as knowing the effect of inflation.