Companies use multiple budget types when planning financials. Two common examples include master and cash budgets – two essential tools in financial control that have distinct differences that should be explored here. We invite readers to discover these variances between them! This article seeks to reveal them. Let’s dive right in!

Definition of Budgeting

Budgeting is the practice of creating a financial strategy for an extended period, typically one calendar year, that details anticipated income and expenditures of an organization, individual or project. Budgeting also serves to allocate resources accordingly; its primary aim being providing an effective framework for financial management to facilitate resource allocation while simultaneously monitoring expenditures so as to achieve financial objectives.

Budgeting is a crucial element of decision-making, forecasting and tracking the performance of any business by comparing actual results with its projected budget. Budgets serve as guides for financial stability, growth and accountability in businesses of any kind.

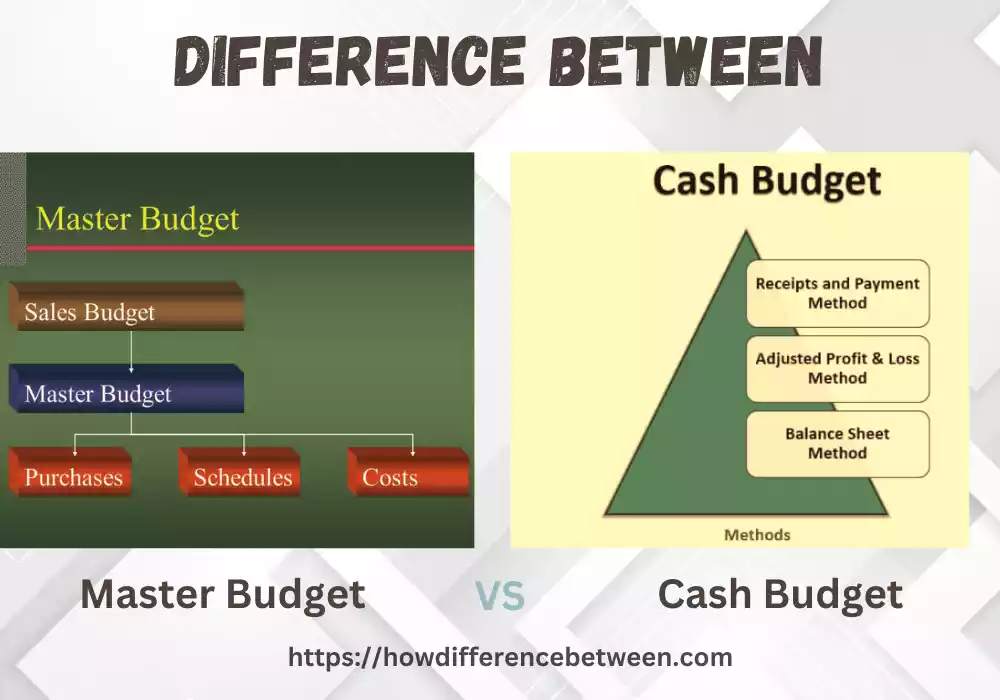

Understanding the Master Budget

A master budget can be described as an extensive financial plan which outlines the anticipated revenues, expenses and financial situation of an organization over the course of one year. It is an essential document that blends the various budgets of each individual and gives an overview of the financial activities of the company.

The components of a master budget:

- Sales budget: The Budget for Sales calculates the expected volume of sales and revenue during the budget period. It provides a foundation for other budgets as well as aids in determining the level of production and the requirements for resources.

- Production Budget: This budget for production defines the amount of goods or services to be manufactured to meet expected demand. It takes into account factors like stock levels, customer demand and capacity for production.

- Direct Materials Budget: It calculates the amount and cost of the raw materials used in production, based in the manufacturing budget. It assists in the planning of purchases, managing the inventory levels, and reducing cost of raw materials.

- Direct Labor Budget: Direct Labor Budget calculates the hours of labor and expenses required to create the quantity budgeted for items or services. It takes into account factors like productivity efficiency, labor costs and availability of the workforce.

- Manufacturing Overhead Budget: The Manufacturing Overhead Budget calculates the indirect manufacturing costs, like utilities maintenance, depreciation, and so on that are associated with the manufacturing process. It assists in making a decision on how much production costs total.

- Budget for Administrative and Selling Expenses: This budget details the expected expenses associated with marketing, selling and administrative tasks. It covers things like the cost of advertising as well as salaries, office costs as well as other overhead costs.

- Budgeted Income Statement: The budgeted income statement contains the expected income and expenditures for the period of budget giving an overview of the expected profit. It assists in assessing its financial results of company.

- Budgeted Balance Sheet: The balance sheet that is budgeted shows the financial standing of the business at the conclusion of the budgetary period. It contains the assets, liabilities and equity, which reflect the effect of budgeted actions on the company’s financial health.

The timeline of a Master Budget The master budget is usually prepared in a year-round manner and covers the fiscal year. However, some companies may also develop short-term master budgets like monthly or quarterly to allow for regular budgeting and monitoring.

The focus of a master budget The principal goal of a master budget is on financial planning and evaluation of performance. It allows organizations to establish goals, efficiently allocate resources and evaluate the financial performance of their organization against goals. It provides a full overview of financial activity within the company and helps in the decision-making process.

Relationship between the Master Budget as well as Long-Term Strategic Plan It is linked to an organization’s long-term strategic plan. It is a reflection of the goals and strategic goals of the company and assists in the translation of these goals into concrete financial plans. The master budget makes sure that finances can be distributed in a way that aligns with the strategic goals of the company and helps to ensure its long-term growth and prosperity.

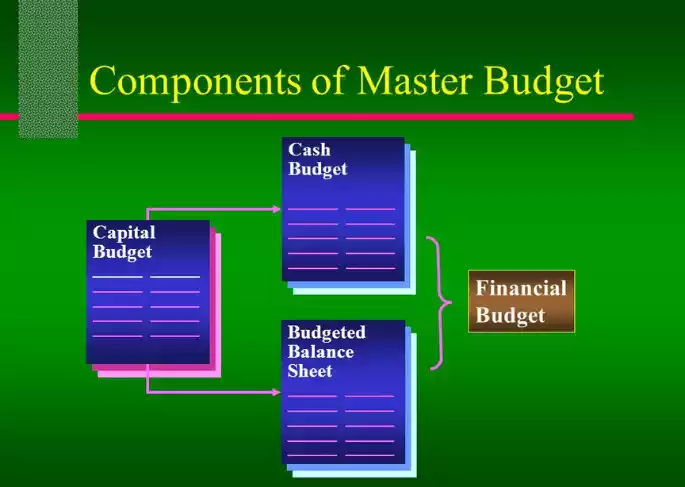

Components of a Master Budget

The components of a master budget:

- sales budget: A budget for sales forecasts the anticipated sales volume in addition to revenue forecast for a particular time. It is dependent on the past, current forecasts for sales, market trends as well as marketing plans. The sales budget acts as an underlying budget for the other budgets within the main budget.

- Production Budget: A budget for production defines the amount of goods or services to be produced in order to meet expected demand. It considers things like stock levels, customer demand production capacity, as well as any adjustments to the forecast of sales.

- Direct Materials Budget: The budget estimates the quantity and price of the raw materials required to produce in accordance with your production plan. It takes into account factors like the amount of inventory required as well as the lead time for purchasing materials, expected spoilage or wastage, and the fluctuation in prices.

- Direct Labor Budget: Direct Labor Budget estimates the amount of labor hours and related costs that are required to make a product. It is based on things like efficiency of production as well as labor rates available to workers, as well as any changes to the production method or the technology.

- Manufacturing Overhead Budget: Manufacturing Overhead Budget includes the indirect manufacturing costs that are associated to the manufacturing process. It covers expenses like utilities maintenance, depreciation, rent and indirect labor. The budget takes into account elements like the historical information, production volume and any expected changes to overhead costs.

- Selling and administrative expenses budget: The budget provides the expected expenses associated with marketing, selling and administrative tasks. It includes items like the cost of advertising as well as commissions, salaries as well as travel costs along with office supplies as well as other overhead costs. The budget is constructed based on previous data, forecasted business operations, and formulated strategies.

- Budgeted Income Statement: The budgeted statement of income contains the projected revenue as well as expenses during the period of budget. It contains sales revenue as well as the price of the goods purchased, operations costs as well as other incomes or expenses. The income statement that is budgeted helps assess the expected profitability of the company and helps identify areas that require improvement in revenue or cost control.

- Budgeted Balance Sheet: The balance sheet that is budgeted shows the financial standing of the company at the close of the budgetary period. It comprises the assets, liabilities and equity, which reflects the effect of the budgeted activity on the financial health of the business. The balance sheet that is budgeted helps evaluate the company’s financial liquidity, solvency, and overall financial stability.

- Cash Budget: While it is not an integral part of the budget master The cash budget can be closely linked and is often integrated into it. The cash budget is a forecast of the cash flow of your organization and outflows, assuring adequate cash management and liquidity. It assists in identifying potential surpluses or cash flow shortfalls and facilitates efficient budgeting of the flow of money.

All of these components make a complete financial plan that orients the company’s financial operations and assists in decision-making processes. The master budget is an outline for allocation of resources, expense control, and evaluation of performance which allows organizations to meet its financial targets and targets.

Importance of a Master Budget

The master budget is of vital importance for the financial management of a company.

Here are the top reasons for why a master budget is essential:

- Financial Planning: The master budget is used as a guideline to plan financial strategies. It allows businesses to establish specific goals and targets for the next period, and align the financial resources to strategic goals. Through estimating expenses, revenues and the requirements for resources The master budget assists to determine the fiscal viability and viability of plans to grow.

- Resource Allocation: The master budget helps in the allocation of resources efficiently. It offers insight into anticipated sales volumes as well as production levels and the corresponding needs for resources. When analyzing the budgeted numbers organisations can allocate funds to materials, labor marketing research and development and other areas in order to maximize the use of resources.

- Performance Evaluation: The master budget serves as a standard to evaluate performance. Through comparing the actual results with the budgeted numbers, companies are able to evaluate their financial performance as well as identify variations. These variances reveal areas where there is strength or weakness and allow management to take corrective action and boost overall performance.

- Decision Making: The master budget facilitates an informed decision-making process. It offers a thorough overview of the financial consequences of different scenarios and options. By using an overall budget for guideline it allows organizations to evaluate the impact that investments could have on their business or cost-saving methods, pricing strategies and other choices on the profitability of cash flow in addition to financial stability.

- Communication and Coordination: The master budget encourages collaboration and communications within an company. It promotes collaboration between various departments and stakeholder groups, while synchronizing their efforts to achieve common financial goals. The master budget also functions as a means of communication making sure that everyone knows the financial goals as well as their individual roles in reaching the goals.

- Cash Management Master Budget: The master budget assists in directing cash flow efficiently. Through forecasting costs, sales as well as cash inflows and outflows, companies can pinpoint times when there could be surpluses or cash shortages. This helps in an efficient cash management strategy like organizing financing or optimizing working capital, in order to keep operations running smoothly and meet the financial obligations.

- Control and accountability: The master budget helps with accountability and control of finances. Through the setting of predetermined goals and performance indicators, it allows companies to track the actual performance and make corrective steps if deviations do occur. The budget holds people as well as departments to account for financial obligations and serves as a basis to evaluate performance and rewards.

- Long-term Financial Stability: The master budget is a key contributor to the long-term stability of financial resources. It integrates financial plans with an organization’s strategic goals and direction and ensures that resources are efficiently allocated and financial risks are handled efficiently. By focusing on liquidity, profitability and the ability to meet its obligations, the master budget helps sustain growth and improve resilience when faced with economic difficulties.

In the end the master budget is an essential tool in financial management. It allows companies to plan, allocate resources, assess the results, make informed decisions and ensure financial stability. It plays an essential role in achieving strategic goals in maximizing profit and ensuring the long-term viability of the business.

An In-Depth Look at the Cash Budget

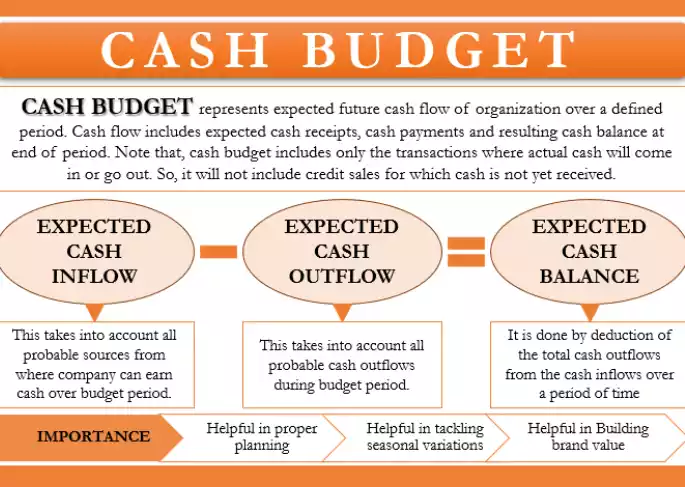

A cash budget can be an essential element of management and financial planning and provides companies with an in-depth analysis of the expected cash inflows and outflows for an extended period. It’s about managing cash flow efficiently and providing sufficient liquidity for efficient operations. This is a comprehensive analysis of the cash budget.

- What is the purpose of a cash budget: The principal objective of a cash budget is to predict and monitor the flow of cash into and outflows. It aids organizations plan and manage their cash reserves to ensure that they have enough cash to fulfill their obligations like paying employees, suppliers as well as lenders as well as identifying opportunities to utilize cash surplus.

- Components of a Cash-Budget: The typical cash budget is composed of the following parts:

- Cash receipts: This segment examines the sources of cash inflows such as cash payments from customers, loan proceeds or investment income, as well as other receipts. It takes into account factors such as sales projections and collections periods, credit terms and other revenue sources.

- Cash Disbursements: The following section provides the cash flow projections for the coming year that include payments to suppliers, salary rent, utilities, tax payments, loans, and other costs. It considers the terms of payment and contractual obligations, as well as historical data, as well as projected expenses.

- Decision Making: Balance budget for cash starts with the cash balance that is the total cash in the account at the start of the budgeting period. It serves as a base for calculation of cash outflows and inflows.

- Final Cash Balance budge: Final Cash Balance budget for cash determines the expected amount of cash by adding cash receipts, and subtracting the cash payments from the initial cash balance. It gives an indication of the expected cash balance at the close of the budgetary period.

- The timeframe for a cash budget: Cash budgets are usually designed for shorter timeframes that are shorter, such as quarterly, monthly or even annually. The shorter timeframes permit more precise cash flow projections, and allow businesses to make swift adjustments to their strategies for managing cash.

- Cash Flow: Management A cash budget is an important part in managing cash flow. It assists organizations in identifying periods that could lead to surpluses or cash shortages and allows them to take proactive steps to ensure sufficient liquidity. With accurate forecasting of cash flows and outflows, companies can improve their working capital efficiency and arrange for additional financing as needed, and put aside cash in reserve or modify their business plans to match with the availability of cash.

- Decision Making Cash Budgets: Provide important information for making decisions. It assists organizations in assessing the financial potential of different initiatives, like capital expenditures managing inventory policy on credit, financing alternatives. By analyzing the impact of these choices in cash flows, companies can make informed decisions that will help them meet their liquidity and stability goals.

- Finance and Investing Activities: The cash budget can help organizations organize their investment and financing actions. It lets them evaluate the need for financing from outside or the possibility of repaying existing debts. It also aids in the investment decision-making process, for example, the evaluation of potential projects, or in determining the right amount of reserves of cash.

- Performance Evaluation: Comparing actual cash flows against the budgeted cash flow will allow organizations to assess their performance. Differences between budgeted and actual cash position may reveal areas that need improvement or possible weaknesses in the management of cash. This data can be used to refine the cash budget for the future and improving general financial efficiency.

- Forecasting Cash Flows: The cash budget is used as the basis for cash forecasting. Through analyzing the historical flow of cash and data on financial performance, and the expected trends for the future companies can create more precise cash flow forecasts. These forecasts can provide valuable information to help with strategizing, managing risk and to ensure financial stability.

The cash budget provides companies with an accurate analysis of cash flows expected and outflows. This allows efficient cash flow management. It assists in making decisions and appraisal of performance as well as investing and financing activities and forecasting of cash flows.

Key Elements of a Cash Budget

The main elements of a budget for cash include:

- Cash inflows: This aspect concentrates on planning and estimating how much cash will be flowing into the business during the period of budgeting. This includes cash inflows from different activities like sales revenues, collections of accounts receivable and loans, investments and other sources of cash flow.

- The Cash Outflow: This aspect involves identifying and preparing for the cash flow that is expected to be outflows in the period of budget. This includes cash payment to cover expenses such as raw material, wages and salaries rent, utility bills loans, tax repayments and any other expenses that lead to cash outflows.

- Beginning Cash Balance: Start Cash Balance starting cash balance is the sum of cash that is available at the beginning of the budgetary period. It acts as the base for the budget for cash and is carried into the next period.

- Ended Cash Balance: end cash balance is the expected situation of the cash balance at conclusion of the budgetary period. It is determined by adjusting the starting cash balance to the cash outflows, and subtracting cash outflows. The balance at the end of the period gives an indication of the company’s liquidity at close of the budgetary period.

- Cash Flow surplus or deficit: The cash budget decides the likelihood of having surplus or a deficit in cash over the course of the budget. If the cash flows are greater than the outflows, a surplus will be projected, which means there is more cash on hand. In contrast, if cash outflows surpass that of the cash inflows, then a deficit projected, which indicates a lack of cash that must be controlled.

- Cash Management Strategies: The cash budget determines the necessity of strategies for managing cash that are based on the projected excess or the deficit. If there is surplus, the company could consider investing the surplus money, paying off the debt, or other methods to increase the returns. If there is an overrun, the company may have to consider financing options, negotiate terms of payment for suppliers, and take cost-cutting strategies.

- Cash Flow Forecast Cash Budget: The cash budget forms the basis of cash flow projection. By studying the cash flow inflows and outflows, companies can forecast their cash balances and take informed decisions about funding, cash management, and investment.

- Control and Monitoring: The budget for cash can be used as a means of monitoring and regulating the flow of cash during the budgetary time. By comparing the actual cash flows and outflows to budgeted figures, businesses are able to identify any variances and take appropriate steps to ensure efficient financial management as well as control.

When considering these essential elements, businesses can come up with an extensive cash budget to help to control your cash flows, guarantee adequate liquidity, and take well-informed financial decisions.

The Difference Between Master and Cash Budget

The master budget as well as the cash budget are both essential aspects of financial planning but they serve distinct purposes and address various aspects of an organization’s financial situation.

These are the main distinctions between the master budget and the cash budget:

- Scope and focus:

- Master Budget Master Budget: The master budget is an all-encompassing financial plan that addresses every aspect of an organization’s operations including production, sales expenditures, financial statements. It provides a summary of the company’s financial performance and helps in the in the process of making decisions.

- Cash budget: A budget for cash is focused on cash outflows and inflows. It gives a comprehensive analysis of the expected cash payments and cash receipts over the course of a particular time period. It focuses on directing cash flow and maintaining sufficient liquidity.

- Timeframe:

- Master Budget Master Budget: The master budget is usually made annually that covers a fiscal year. It offers a longer-term view and is a reference point for financial planning and evaluation.

- Cash Budget: A cash budget is typically prepared for shorter durations that are shorter, such as monthly or quarterly. It is focused on short-term cash flow management, and offers insight into the company’s cash situation on an immediately.

- Components:

- Master Budget: Master Budget of a variety of interconnected budgets comprising production budget, sales budget direct materials budget direct labor budget manufacturing overhead budget the budget for administrative and selling expenses and budgeted income statement and the budgeted balance sheet. It combines these elements to give a complete picture of the organization’s financial performance.

- Cash Budget: The budget for cash is comprised of cash inflows, cash outflows and cash inflows, the beginning of the cash balance, cash balance at the end and cash in surplus, or deficiency. It is focused on cash-related operations and offers an extensive analysis of the company’s cash situation.

- Purpose:

- Master Budget: The master budget acts as a tool to plan financial goals that helps organizations set objectives, allocate resources and assess the performance. It offers a complete structure to make financial decisions and provides the company’s strategic direction.

- Cash budget: A budget for cash concentrates on the management of cash flows and ensures that the business has enough cash in reserve to meet its obligations and finance its activities. It assists in managing the liquidity of cash, identifying any excess or deficit cash, and taking informed decisions about cash outflows and inflows.

- Integration:

- Master Budget: The master budget integrates diverse budgets into an integrated and complete financial plan. It ensures that all the elements of the budget are aligned with one another and are in line with the company’s overall financial objectives.

- Cash budget: A budget for cash is typically included in the overall budget because it provides useful information about the management of cash flows. But, it could also be designed as a separate budget that focuses on cash outflows and inflows.

Master budgets are an extensive financial plan that covers the entirety of an organisation’s operations. The cash budget is specifically focused on controlling the flow of cash and making sure that there is enough liquidity. The master budget gives an outlook on the long term, while the cash budget is focused on managing cash flow in the short-term. Both budgets play a crucial role in managing and financial planning however, they each have their own boundaries, timelines and goals.

Scope and Coverage

The coverage and scope that the master budget as well as cash budget vary in relation to the financial aspects that they cover.

Here’s the breakdown of their coverage and scope:

- Master Budget:

- Sales: The master budget contains an estimate of sales that reflects the expected volume of sales and revenue for a certain time.

- Production: It is the production budget, which defines the amount of products or services to be made according to sales projections as well as other variables.

- Budgeting for expenses: The master budget is comprised of the various budgets for expenses, which include direct materials and manufacturing overhead, direct labor and sales and administrative costs.

- Financial Statements: They include budgeted income statements as well as budgeted balance sheets which summarize the expected financial performance as well as its financial standing.

The master budget gives complete information about the financial operations of an organization that include production, sales as well as various categories of expense. It combines these components to forecast the company’s financial performance and its position.

- Cash Budget

- Cash inflows: The budget for cash concentrates on planning and estimating for cash flows within the company which include cash receipts from loans, sales investments, and various other sources.

- Cash Outflows: It examines the expected cash flow of an organization like cash payments to cover expenses such as purchase, loan repayments tax, as well as other cash-related expenditures.

- Check Balances of Cash: A budget for cash is a record of the cash balance at the beginning and estimates the end cash balance, giving insight into the cash position of the company.

The budget for cash specifically focuses on the management of cash flows, focusing on the cash flow inflows and outflows to ensure that there is enough liquidity for the company’s operations. It is focused on cash flow planning and offers a thorough analysis of the company’s cash position.

In short the master budget encompasses more financial aspects like production, sales, expenses and financial statements, presenting the complete financial plan. However the cash budget is focused on managing cash flow, keeping track of the cash flow inflows and outflows and estimating the company’s cash position.

Integration of Master Budget and Cash Budget

Integrating the master budget as well as the cash budget is crucial to efficient budgeting and managing financials.

This is how the two budgets can be combined:

- Cash Flow The considerations within the Master Budget:

- Cash Inflows: The master budget must include the cash flow projections of the cash budget in the revenue and sales sections. This ensures that the projected cash receipts are in line with the company’s sales projections.

- Cash outflows: The main budget should be based on the cash flow projections of the cash budget in estimating the expenses. This helps to accurately forecast the cash requirements for different expenditures like operating costs, production costs and obligations to finance.

- Coordination of the Budgeted Income Statement and the Cash Budget

- Revenue and Expenses: The income statement that is budgeted within the budget master should reflect the anticipated revenue and expenditure. The figures must be in line with the cash flow and outflow projections that are in the financial budget.

- Timing Differentialities: The integration makes sure that the timing differences between the recognition of revenues and incurring costs and the actual cash flows and outflows are appropriately included on both budgets.

- Management of Cash Surplus or Deficiency:

- Surplus Management: If the cash budget shows an increase in surplus, the master budget should include strategies to use the surplus cash efficiently. This might include investing the surplus funds, reducing debt or any other financial decision that helps improve cash utilization.

- Deficit Management: If cash management shows an unsustainable deficit, the master budget must consider ways to reduce the deficit. This could include exploring ways to finance or negotiating terms for payment for suppliers or taking cost-saving measures to boost cash flow.

- Monitoring and Control

- Variance Analysis: Continuous monitoring and comparison of the actual cash flows against projections of the cash budget help to identify any deviations. This analysis gives insight into the efficiency in cash-management strategies and permits rapid adjustments when needed.

- Financial Forecasts for Cash: A budget’s cash outflow and inflow projections are able to be refined in accordance with actual performance and integrated into the future budget masters. This process of iteration helps increase precision of forecasts for cash flows as well as helps improve the overall process of financial planning.

By integrating the master plan and cash budget, businesses can improve their financial planning and managing cashflow, and take well-informed decisions based on the expected financial performance of the business and cash flow position. This allows better coordination between all aspects of the financial aspect of the business and helps in the accomplishment of financial objectives.

Conclusion

The master budget, as well as the cash budget, are two of the most important elements of management and financial planning. Although the master plan gives the complete picture of the financial operations of an organization while the cash budget is focused on regulating cash flows, outflows and liquidity.

The master budget incorporates a variety of factors like production, sales as well as financial statements. It provides a long-term view for financial planning and making decisions. In contrast the cash budget is focused on the management of cash flow in the short term monitoring cash inflows and outflows to ensure adequate liquidity to support the business’s needs.

The integration of both budgets is vital to effective financial management. When considering cash flow projections made in the cash budget of the budget master, businesses can be able to align their expenses and revenue estimates with projected cash flows. This helps optimize the cash flow, coping with deficits or cash surpluses and making well-informed financial decisions.

Regularly analyzing variances, monitoring and improving cash flow forecasts that are based on actual performance improve the precision for financial management and monitoring. Integrating the master budget with the cash budgets allows organizations to get an overall picture of their financial position and effectively monitor their cash flows and take informed decisions to meet their financial objectives.