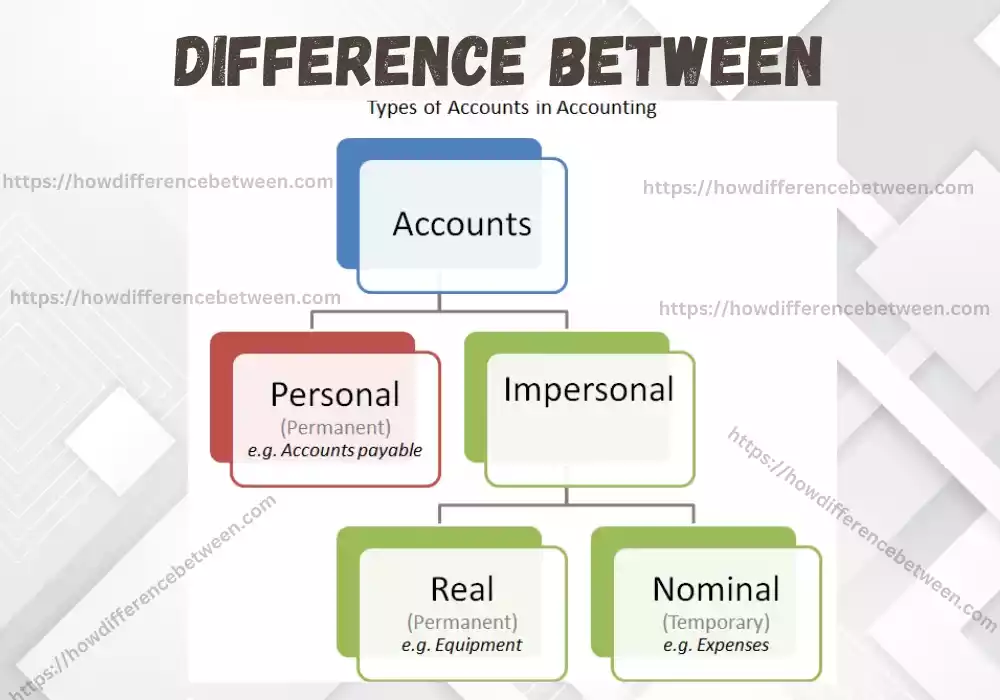

In the accounting world knowing the difference between various types of accounts is essential. Two main types that account fall are nominal and real accounts. Although both play a crucial role in recording financial transactions, they differ in their character, features, and purposes. This article will explore and explain the major distinctions between nominal and real accounts, shining some light on their distinctive characteristics and significance in accounting.

Definition of Accounts in Accounting

In the field of accounting, an account is a systematically recorded recording of financial transactions that are related to a specific type of category. It is a method for organizing, classifying and presenting financial data to aid in analysis, reporting and other decision-making needs. Each account is a distinct part of a company’s financial operations and is used to monitor the flow of cash as well as liabilities, assets and equity.

An account is composed of three essential components:

- Account Name: This indicates the specific item or category that is being monitored. Examples are Cash, Accounts Receivable inventory, accounts payable Rent Expense, Sales Revenue and the Owner’s Equity.

- The Account: Number is a unique numeric code assigned to every account to help organize and facilitate references in the system of accounting. Account numbers are typically employed in larger accounting systems to speed up the entry of data and retrieve it.

- Balance of the Account: This is the sum of all transactions recorded within the account. It is determined by taking into account the difference between debits (amounts recorded in the lower left corner of the bank account) and the credits (amounts placed onto the other side) as per double-entry accounting principles.

Accounts are generally divided into five main categories, referred to by the name chart of accounts.

- Assets: Assets are the resources owned or controlled by a company with economic worth. Examples include inventory, cash equipment, accounts receivable.

- Liabilities: Debts or obligations due by a company to other entities. Examples include loans, accounts payable and accrued expense.

- Equity: The interest that remains in the business’s assets after subtracting liabilities. It is the ownership stake of the shareholders or owners. Examples include the share capital, the drawing and retained earnings.

- Revenue: Earnings derived by the sale of goods or services that are part of the routine operation of a business. Examples include sales revenues or service fees, as well as interest income.

- Charges: Costs that are incurred in the process of creating revenues. Examples include rent as well as wages and salaries utility, as well as advertising costs.

Through keeping accounts in order and logging transactions in a systematic manner accounting professionals can efficiently monitor and analyze financial data as well as prepare financial statements. adhere to regulatory requirements and make educated decisions to improve the efficiency of their business.

Importance of differentiating between nominal and real accounts

The distinction between nominal and real accounts is essential in accounting due to a variety of reasons:

- The preparation of financial statements: The nominal as well as real account are accounted for different in the financial statement. Real accounts are included within the balance sheets however nominal ones are reflected as income in the statement of earnings. Knowing the difference is crucial to ensure accurate and reliable financial reporting.

- The measurement of profit or loss: The nominal accounts are associated with expenses, revenues as well as losses, gains and. When they are distinguished from actual accounts, companies are able to calculate their net earnings or net loss with precision. This information is essential in assessing the financial performance and the profitability of a company.

- Closure and Transfer of Balances: Nominal accounts are of a temporary the sense that they are closed at the close of an accounting period. Balances from those accounts go to an income summation account, or directly in the form of retained income. Real accounts are, however are able to carry forward their balances to future period of accounting. Knowing this procedure will ensure an accurate closing and transfer of balances.

- Making Decisions: The distinction between real and nominal accounts gives management accurate and pertinent financial data. This enables them to take educated decisions about the control of costs and the generation of revenue as well as investment opportunities and the overall strategy of business. Real-time accounts provide insight into the financial condition and the long-term viability of a company, whereas nominal accounts provide insight into its financial performance in the short term.

- Conformity to Accounting Standards: Accounting standards like the generally accepted accounting principles (GAAP) and the International Financial Reporting Standards (IFRS) set out specific guidelines to report financial information. Making sure that nominal accounts are distinguished from real accounts is a way to ensure that you are in the compliance of these standards, which improves the comparability and transparency of financial statements.

- Taxation and Legal Compliance: The tax authorities and regulatory bodies require accurate financial reports to ensure tax assessment and audits as well as legal compliance. The identification and classification of real and nominal accounts will ensure that the financial statements are in line with tax laws and legal demands.

- Internal and Auditing Controls: The distinction between the real and nominal accounts helps in auditors in their audits. Auditors are able to review the balances and transactions of the accounts on their own, ensuring they are sure that financial reports aren’t contaminated from errors and material misstatements. This also improves internal controls, allowing companies to track and reconcile transactions with accuracy.

Separating between real and nominal accounts is vital to ensure accurate financial reporting, making decisions, ensuring conformity with accounting guidelines as well as tax and legal compliance in auditing, as well as ensuring internal control. It gives a clear picture regarding the overall financial health, position and financial health of a company which allows those involved to make informed choices and evaluate its financial health.

Nominal Accounts

The nominal account, often referred to as account for income statements, is a class of accounting accounts which are associated with revenue and expenses, gains and losses.

These are the most important facts regarding nominal accounts:

- Nature: Nominal accounting accounts reflect the diverse sources of revenue and expenses for a business in its normal operation. They track transactions that take place within a certain accounting period.

- Temporary nature: Nominal accounts have a limited life. They are created at the beginning of each accounting period and shut at the close of that period to determine net income or loss. This means that the balances of their accounts get reset back to zero each time at beginning of each accounting cycle.

- Different types of nominal accounts:

There exist many kinds of nominal accounts comprising:- Sales Accounts: These accounts track the earnings generated by the sale of either goods or services. Examples include sales revenues as well as service fees, rent, and interest income.

- Expense Accounts: Expenses accounts track the expenses incurred by a company to run and generate revenues. Examples include rent expenses, wages and salaries and other expenses for utilities, advertising and depreciation expense.

- Gain Accounts: Gain account are the earnings generated by operations that are not part of the core business operations. For instance, gains can be derived from disposal of assets, investments and forex exchange.

- Loss Accounts: The word “d” means “evil”. The Loss Accounts account records the costs or losses that result from non-operating operations or unexpected circumstances. Examples include losses resulting from the disposal of assets, writing off bad debts or losses due to natural catastrophes.

- Treatment of Financial Statements: After the conclusion of the accounting period the balances in nominal accounts are refunded by transferring them to an income summary account or directly into the account of retained earnings. This process assists in determining the net profit or net loss for the time period and assists in the preparation of the income statement.

- Effects on Net Income:Balances in revenue accounts can increase net income while the balances of expenses gains, loss, and accounts reduce net income. Net income is a significant financial indicator that reveals the efficiency of a company.

Understanding nominal accounts is vital to accurately assessing a company’s financial performance and determining its net profit and net losses, making the income statement and making informed choices in the light of expense and revenue analysis.

Real Accounts

The real accounts are also referred to as account balance sheets, is a class of accounting accounts which deal with assets, liabilities, as well as owner’s equity.

Here are a few key facts regarding real accounts:

- Nature: Real accounts reflect the current financial position of a company. They record the assets as well as liabilities and equity that remain after an accounting time.

- Permanent Nature: Accounts with real value have a long or continuous life span. Contrary to nominal accounts, real accounts do not close at the close of the accounting time. Instead the balances of their accounts are carried over to the following time periods.

- Real accounts are of various types Real accounts cover a variety of types of categories, such as:a. asset account: The accounts document the assets owned or controlled by a company. Examples include accounts receivable, cash inventory, inventory and property plant and equipment (PP&E) as well as investments and expense prepaid.b.

- The Liability: Accounts account tracks the debts or obligations that a company owes to third entities. Examples include loans, accounts payable, to be paid, accrued expense, as well as deferred revenues.

- The Equity: Accounts reflect the ownership stake in a company. They comprise equity capital as well as drawings, retained earnings as well as any other component of equity.

- Treatment of financial statements: Real accounts do not close at the close of the accounting period. The balances of their accounts are carried over to the following period, which allows for the integrity of financial data. Real-time accounts are recorded in the balance sheet that provides a picture of the financial situation of a company at a particular moment in time.

- Impact on the Balance Sheet: Real accounts impact the balance sheet through reflecting the assets, liabilities and equity of the business. These changes can signal changes in the financial position of a company and the worth of a company’s obligations and resources.

Understanding the importance of real-time accounts is vital to assess the financial health and the long-term viability of a company. By keeping track of the assets, liabilities, and equity, companies can make educated decisions about the possibility of investing as well as capital structure, debt management as well as overall health of the financial system. Real accounts offer a complete overview of a company’s financial position and help with the analysis of financials, external reports and stakeholder analysis.

Differences between Nominal and Real Accounts

The distinction between nominal accounts or real account is crucial in accounting.

Here are the major distinctions between these two kinds of accounts:

- Nature of Transactions Recorded:

- Nominal Bank Accounts: These accounts track transactions relating to revenue or expenses, gains and losses. They record the income and expenditure produced during the normal business operation.

- Real Accounts: These accounts record transactions related to assets or liabilities as well as equity of the owner. They are a representation of the financial health of a business and include obligations, resources as well as ownership rights.

- Time Period:

- Nominal Accounts: These accounts are merely only temporary, and cover the accounting period of a particular time, usually a quarter, month or a year. The balances of their accounts can be reset back to zero after the beginning of every accounting period.

- Real Accounts: Real accounts are permanent accounts that last for different accounting time periods. The balances of their accounts are carried forward from one year to the next, which ensures continuous flow of financial information.

- Closure and Transfer

- Nominal accounts: At the close of the accounting period nominal accounts are closed by moving their balances into an income summation account, or directly into retained profits. This helps to determine the net loss or net income for the entire period.

- Real Accounts: Real Accounts aren’t shut at the close each accounting cycle. Instead the balances of their accounts are carried forward to future period without any reset or closing.

- Effect on Financial Statements

- Nominal Accounts: These accounts are included on the income report (also called”the statement of profit and losses”). They are directly involved in accounting for net losses or income, offering an insight into a company’s financial performance throughout a certain time.

- Real Accounts: Real accounts appear within the balance sheets. They are a record of the company’s assets, obligations, and equity of the owner and provide a picture of its financial situation at a specific date.

- Importance of Decision-Making

- Nominal Accounts: Understanding nominal accounts can help in evaluating a company’s production of revenue, its expense management and overall profitability. It aids in making short-term operational decisions.

- Real Accounts: Real accounts are vital to assess a company’s financial health, viability over the long term and its the ability to meet its obligations. They provide insight into the management of assets, debt levels and equity composition aiding in strategic decisions and financial planning.

Through the distinction between nominal and real accounts, both stakeholders and accountants can precisely measure the financial performance of their business, evaluate its financial position, take educated decisions, and abide with accounting regulations and standards. Both kinds of accounts have different functions and provide a thorough understanding of the financial facets.

Comparison Chart

Here’s a comparison chart highlighting the key differences between nominal accounts and real accounts:

| Aspect | Nominal Accounts | Real Accounts |

|---|---|---|

| Nature of Transactions Recorded | Revenues, expenses, gains, and losses | Assets, liabilities, and owner’s equity |

| Time Period | Temporary – covers a specific accounting period | Permanent – persist across multiple accounting periods |

| Closure and Transfer | Closed at the end of the accounting period, balances transferred to income summary or retained earnings | Not closed at the end of the accounting period, balances carried forward to subsequent periods |

| Financial Statement Impact | Appear on the income statement, contribute to net income/net loss calculation | Reflected on the balance sheet, provide information on financial position |

| Importance for Decision-Making | Evaluate revenue generation, expense management, and short-term profitability | Assess financial position, long-term viability, and strategic decision-making |

Examples of Nominal and Real Accounts

Nominal Accounts:

- Revenue Accounts:

- Sales Revenue

- Service Fees

- Rental Income

- Interest Income

- Dividend Income

- Expense Accounts:

- Salaries and Wages Expense

- Rent Expense

- Utilities Expense

- Advertising Expense

- Depreciation Expense

- Gain Accounts:

- Gain on Sale of Assets

- Gain on Foreign Currency Exchange

- Gain on Investments

- Loss Accounts:

- Loss on Sale of Assets

- Loss on Bad Debts

- Loss on Disposal of Assets

Real Accounts:

- Asset Accounts:

- Cash

- Accounts Receivable

- Inventory

- Property, Plant, and Equipment

- Investments

- Liability Accounts:

- Accounts Payable

- Loans Payable

- Accrued Expenses

- Notes Payable

- Deferred Revenue

- Equity Accounts:

- Share Capital

- Retained Earnings

- Owner’s Drawings

- Common Stock

- Additional Paid-in Capital

It’s important to note that these examples are not exhaustive, and there can be additional accounts within each category. The specific accounts used by a business may vary depending on its industry, size, and specific circumstances.

Nature of Accounts

The character of accounts in accounting is the type of classification or category to which an account is classified according to its features and purposes. Being aware of the different types of accounts is vital to ensure an accurate classification, recording as well as analysis of transactions in financial records. These are the most common types of accounts, based on their characteristics:

- Asset Accounts:

- Nature: Asset accounts are the resources controlled or owned by a company and have economic worth.

- Examples include: Accounts Receivable, Cash Inventory, Property Plant, and Equipment (PP&E) and Investments.

- Liability Accounts:

- Type: Accounts for Liability monitor the debts or obligations due by a company to other entities.

- Examples: Accounts payable, Loans Payable, Accrued Costs Notes Payable, Deferred Revenue.

- Equity Accounts:

- Nature: The nature of equity accounts are the ownership stake in a company. They are the result of the interest that remains after removing liabilities from assets.

- Example: Share Capital, Retained Earnings Owner’s Equity, Common Stock.

- Revenue Accounts:

- Nature: The Revenue Accounts record revenue generated by the sale of products or services that are part of the business’s normal business.

- Examples: Sales Revenue, Service Fees, Rental Income, Interest Income.

- Accounts for Expenses:

- Nature: Expense records track the costs that are incurred by a company to operate and generate revenues.

- Example: Salaries and Wages Expense, Rent Expense, Utilities Expense Advertising Expense.

- Gain Accounts:

- The nature of the account: These accounts are earnings from activities that are not operational or transactions that are not related to the business’s primary operations.

- Examples: Gains on Sale of Assets, Gain on Investments and Gains on Foreign Currency Exchange.

- Loss Accounts:

- The nature of the account: loss accounts track expenses or losses incurred as a result of unplanned events or activities that are not operational.

- Examples: Such as Loss on Sale Assets and bad debts, loss on the disposal of Assets.

Understanding the accounting process aids in the proper classification and arrangement of financial transactions. It also helps in the accurate recording of transactions in proper accounts, and an accurate examination of financial reports. It gives insight into the various elements of a company’s financial operations, including its assets as well as its liabilities, equity income and expenditures.

Types of Transactions

When it comes to accounting, the term “transactions” are the exchange of funds or other events that affect a company’s financial situation and are recorded in the financial reports.

The most frequent kinds of transactions:

- Sales Transactions: Transactions are the exchange of products or services by a company to its clients to pay for the services. They lead to increased revenue as well as accounting of account receivables or cash.

- Purchase Transactions: Buy transactions take place when businesses purchase items or services from vendors or suppliers. They cause an increase in expenditure or the accounting the accounts payable.

- cash transactions: These refer to the acceptance or payment of cash by a company. This could include cash purchases, sales as well as cash payments to cover expenses, as well as cash receipts from customers and other sources.

- Expense Transactions: Expense transactions are the cost an organization incurs during its day-to-day activities. They can be a result of expenses for rent, utilities, salaries and wages, advertising and various other operating expenses.

- Investment Transactions: The term “investment transactions” refers to the happen when a company invests money in securities or assets. This could include the purchase of bonds, stocks real estate, bonds and other long-term assets.

- Financing Transactions: Financial transactions involve borrowing or the repayment of funds from a company to fund its operations or investment. It could involve the taking of loans or bonds, reminding debt as well as issuing equity-based shares.

- Adjusting Entry: Adjusting entries are completed at the end of an accounting period in order to document transactions that aren’t recorded in the normal process of business. These entries cover depreciation, accruals, deferrals and allowances for bad debts.

- Depreciation and amortization: Transactions that concern the assignment of the expense of long-term assets over their productive life, like recording depreciation of buildings, or amortization for tangible assets.

- Noncash Transactions: Noncash transactions involve exchanges or other events that do not require the instant transfer of money. Some examples include barter transactions, the issuance of shares to exchange assets or conversion of debt into equity.

- Closing Entry: Entries are recorded at the close of an accounting period. They transfer balances from the nominal accounts (revenue and expense accounts, as well as gain as well as loss accounts) to the account for retained earnings.

Understanding the various types of transactions can help in recording and categorizing financial activities when preparing financial statements, studying an organization’s performance on financial businesses and adhering to accounting regulations and principles.

Treatment of Balances

The method of handling balances in accounting is the way the balances at the end of different accounts are treated at the close of the accounting period. The method of treatment is dependent depending on what type of account as well as the purpose of it.

Here are the most common methods of balances:

- Nominal Accounts:

- Revenue accounts: The closing account balance that represents the amount of income earned to close the account, by moving it into the account for income and summary, or directly into retained profits. This helps to determine the net income of the time.

- Expense Accounts: The final balance of the expense accounts which represents the expenses of the expenses, is closed by transfer into the account for income summaries, or directly into retained profits. This process allows you to determine the net profit or net loss of the period.

- Gain Accounts: The final balance of the gain accounts, which is a result of non-operating activity will be paid off by either moving it into the account for income and summary, or directly to the retained earnings.

- Loss Accounts: When the balance of the loss accounts which are a result of expenses incurred from activities that are not operational, is closed by transferring it to an income summary account, or directly in the case of retained income.

- Real Accounts:

- Capital Accounts: the closing balance of accounts for assets will be carried over to the following period of accounting without reset or closing. The balance is a reflection of the cumulative worth of assets.

- Liability Accounts: The closing balance of the liability accounts is carried forward into the next accounting period, without reset or closing. The balance is a reflection of the continuing obligations of the company.

- equity accounts: the closing equity balance comprising retained earnings and owner’s equity is transferred to following accounting period without reset or closing. The balance represents the total ownership stake in the company.

- Closing Entry:

- After the period of accounting, nominal accounts (revenue and expense accounts, as well as account for loss and gain) close by moving their funds into an income summation account. The balance of the account for income summaries is transferred to the account for retained earnings or directly to equity accounts.

- The reason for close entries is to set the nominal balances of accounts to zero and calculate the net profit as well as net losses for that time period. This process helps prepare an account for the upcoming accounting period.

When you treat balances in a proper manner at the close of the accounting period, companies can precisely measure their performance in the financial arena, keep the consistency of actual balances in their accounts, and ensure the correct allocation of earnings and expenses. It also aids in the production of tax reports and compliance with accounting regulations.

Effect on Financial Statements

The impact on financial statements refers to the way the impact of different events and transactions on what is presented as financial data within the statements of financials.

Here’s a summary of the impacts on the three major financial statements:

- Balance Sheet:

- Assets: The increase in assets (such as accounts payable, cash as well as inventory) are reflected in the balance sheet in an increase in the asset account. The decrease in assets is recorded as a decrease in the asset account.

- Liabilities: Increases in the amount of liabilities (such as the accounts payable and loans payable) are shown in the balance sheets as an increase in the account for liability. The reduction in liabilities is recorded as a decrease in the liability account.

- Equity: Expenses that increase equity (such as the addition of investments and retained income) are shown in the balance sheet, as an increase in the equity account. Reductions on equity (such as losses from distributions as well as net losses) are recorded as a decrease in the equity account.

- The balance sheet is an overview of the financial standing of a company at a certain moment in time. It’s dependent on the accounts for the balance of liabilities, assets as well as equity accounts.

- Income Statement:

- Revenues: Revenues that represent the income earned from sales or services delivered, are reported in the financial statement. Revenue accounts that are boosted (such as sales revenue or service fee) are recorded as a higher level of revenue, which leads to a greater net income. Increases in revenue accounts results in lower revenues and, as a result less net income.

- Costs: Expenses, which are the costs that are incurred in order in order to earn revenue are reflected in the financial statement. The increase in the expenses accounts (such as wages and salaries rental expense) result in higher costs and smaller net earnings. The reduction in expense accounts results in lower expenses and ultimately, a higher net income.

- The income statement is a summary of what the performance in financial terms of a company for a particular time period that is usually a month quarter, or year which is affected by expense and revenue accounts.

- The Cash Flow Statement

- Operating Activities: Cash flows from operations are impacted by changes in the expense and revenue accounts. The growth in revenue results in greater cash flows, whereas expenditure increases result in greater cash outflows.

- Investment Activities: The cash flows generated by investment activities are impacted by transactions involving assets that are long-term like plants, property, investment equipment. Asset purchases result in cash outflows, whereas the sale or disposal of assets lead to cash inflows.

- Financial Activities: The cash flows generated by finance activities can be influenced by the transactions connected to the company’s capital structure, like borrowing, debt repayments and the issuance of equity shares or dividends. Equity issuances and borrowings bring in cash, while dividend and debt repayments result in cash outflows.

- A cash flow report contains details about the company’s cash flow inflows and outflows for an exact time period. It is affected by a variety of transactions.

Understanding the impact of financial statements and transactions is vital to evaluate the performance, position and liquidity of a company. It aids stakeholders to evaluate the financial performance, evaluate the patterns of cash flow and make educated choices based on information provided in the financial statements.

Summary

Understanding the difference between Nominal and Real accounts is essential for maintaining accurate financial records and making informed business decisions. Nominal accounts deal with revenues, expenses, gains, and losses and are temporary, while real accounts encompass assets, liabilities, and owner’s equity and are permanent. Both types of accounts play a vital role in presenting a comprehensive view of a company’s financial health.